A good “spread” of debtors – they would rather see 20 or 30 customers in your ledger than heavy reliance on 2 or 3 (- however, please see “spot or single invoice factoring” below).In simple terms factors like and will therefore generally charge less where there is:

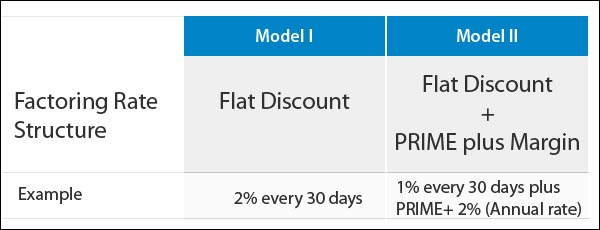

Whilst they will look at your own company, they are even more interested in the customers you supply – their track record, credit history and the industry in which they operate. Like any lender or funder, factoring companies will measure risk against reward – the greater the perceived risk the higher the reward they will seek – a greater cost to you.įactoring companies tend to look at several key factors when it comes to providing a facility. This can make a comparison between companies and terms very difficult. There may be other charges and the terminology can vary from company to company. Most factoring companies make extra charges such as arrangement fees (to set up the facility), exit or termination fees, survey fees, audit fees and penalty fees. Service fee – the charge for managing your invoices, account and ledger and usually calculated as a percentage of gross turnover.These charges are calculated on a percentage basis of the invoices value and usually range from between 0.5-5%. It follows that if your invoices have a longer repayment term you will pay more in your factor rate than an invoice with a shorter term.

Factoring period length is the amount of time it takes your customer to pay their invoice. The factor rate is the amount that the factoring company charges you on a weekly or monthly basis, for releasing the cash and is very similar to the interest a bank would charge for letting you borrow money.

0 kommentar(er)

0 kommentar(er)